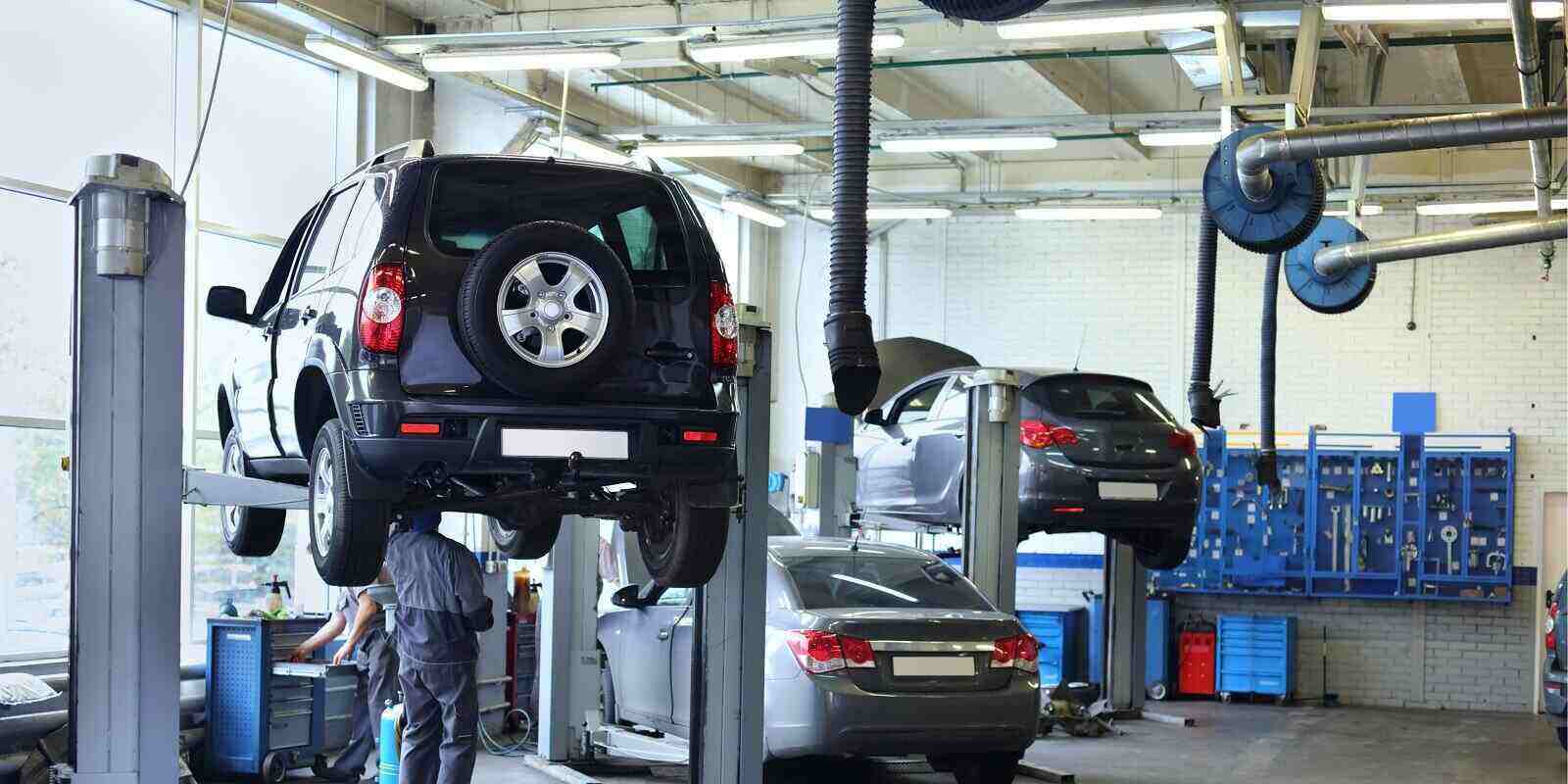

What Does Garage Keepers Insurance Cover?

All automotive businesses, including auto body shops, service stations, towing companies and parking garages, risk inherent liabilities when...

3 min read

Chris Bakes

:

January 29, 2026

Assisted living directors must balance compassion and control since they are responsible for both resident safety and their business’s financial security. Senior care creates many risks and obstacles to achieving this balance, which is why liability coverage is essential for assisted living directors to protect their operations against accidents, legal claims, regulatory lapses, and other risks.

This guide to liability coverage for assisted living directors covers the insurance options directors need to know, how protection works, and how facility leaders can use the right strategies to mitigate their risks in a challenging industry.

Assisted living facilities provide essential care for seniors, blurring the lines between housing, medical care, and end-of-life services. Assisted living, therefore, involves many different risk surfaces that facility directors must be prepared for, such as:

These and other challenges make risk management a top priority for assisted living facility directors. In particular, three types of liability coverage must be clearly recognized and strategically adopted for directors to protect their assets, residents, and business.

General liability policies cover property damage from covered events such as weather, fire, and theft. They also cover bodily injuries. For example, if residents, families, or employees slip and fall on-site, general liability typically applies to their medical expenses and potential lawsuit costs.

Why is it Necessary?

General liability coverage addresses many of the hazards present in day-to-day assisted living facility operations. Long-term care facilities house residents of many differing physical abilities; even when supervised, accidents can result in injuries to residents and legal claims from residents or their families.

Professional liability, also known as Errors & Omissions coverage, protects facilities from lawsuits involving medical oversight, medication dosing, and conduct or negligence.

Why is it Necessary?

In assisted living facilities, workers are responsible for complex healthcare schedules, wherein errors or omissions can result in injury or even death. Residents or their families may seek legal action against facilities that fail to meet industry care standards.

Assisted living facilities provide care to residents, but they also operate as businesses with a duty to protect their employees. If caretakers are injured while working at the facility, their expensive medical costs, lost wages, and other needs must be covered by robust workers compensation.

Why is it Necessary?

Working at an assisted living facility is physically demanding, as workers must often lift, carry, and assist residents in their rooms and throughout the grounds. Talented, trained facility workers value comprehensive employee protections, knowing they can rely on the facility to replace their lost wages and medical expenses if something happens. This kind of coverage is also legally mandated in most states.

In addition to these core coverage types, facility directors should consider supplemental insurance coverage, including:

Strategic risk mitigation involves liability coverage, but coverage alone is not enough to protect the business from harm. Strategic risk management initiatives should be implemented to support the coverage, including:

Assisted living facility directors must confront diverse risks and adapt to changing circumstances. Resident safety, employee fairness, and regulatory context should all factor into directors’ strategies for versatile liability coverage.

At Pro Insurance Group, our experienced team recognizes the distinct risks associated with operating assisted living facilities. Our goal is to provide coverage that protects assisted living facilities at each level of their risk assessment, from their residents’ safety and employees’ working conditions to their business’s reputation.

Contact our team today for comprehensive liability coverage that includes the policies your facility needs to manage risk, safeguard residents, and retain employees.

All automotive businesses, including auto body shops, service stations, towing companies and parking garages, risk inherent liabilities when...

Serving on the board of directors or as an officer transfers risks less common in other occupations. Directors and officers (D&O) insurance provides...